Monday, January 30, 2006

Library Journal Review

Bob Herbert Gets it, As Usual

We are now in a time when a college education is a virtual prerequisite for achieving or maintaining a middle-class lifestyle. "Only the kids who get a postsecondary education are even keeping even in terms of income in their lives, and so forth," said Gary Orfield, a professor at the Harvard Graduate School of Education and director of the Civil Rights Project. "The rest are falling behind, year by year. Only about a twelfth of the Latino kids and maybe a sixth of the black kids are getting college degrees. The rest of them aren't getting ready for anything that's going to have much of a future in the American economy."

Friday, January 27, 2006

Business Week Review of GenDebt

While younger readers may see a real crisis, baby boomers will probably view their concerns as nothing more than a phase they should outgrow. I think those boomers would be wrong.

Bush Swears to Uphold Giant Tax Increase...

You see, if the Bush tax cuts are allowed to expire, our budget will be in surplus by 2012. But if they are made permanent, as he has vowed to do, we'll be facing deficits out the wazoo.

The long-term budget forecast is gloomier, particularly if Bush and Congress agree to extend the tax cuts. In 2016, the deficit would be nearly $400 billion. Beyond that, the costs of Medicare, Medicaid and Social Security are projected to rise to a level that “economic growth alone is unlikely to alleviate,” the report says. “A substantial reduction in the growth of spending, and perhaps a sizable increase in taxes as a share of the economy, will be necessary for fiscal stability to be at all likely in the coming decades.”

Obviously, if you're in your 20s, your tax-paying life will mostly take place "in the coming decades."

Thursday, January 26, 2006

Wednesday, January 25, 2006

Crap Job Propaganda

Tuesday, January 24, 2006

Adult Children till 30

A very real problem that deserves legislative attention; a backwards, infantilizing way to address it.

An Empire built on Lateness

This is a danger that haunts borrowers of all types, but I believe the problem is worse for student loan borrowers, for these reasons:

1) Unlike credit card debtors, students have no choice but to borrow their way through school. It's the acceptable, responsible thing to do.

2) Besides the fees and inflated interest rates that happen if you're a "bad" borrower (making late payments), you can also get in trouble for being a "good" borrower. If you take advantage of deferments so as not to become delinquent, you'll get walloped with even more charges in the end.

3) Because student loans are not dischargeable in bankruptcy, the banks have no incentive to settle. Often, if your credit card debt is "charged-off" (ie, sold to a collection agency) that agency will accept less than the face value, because they acquired your debt for less than face value. With student loans, the banks can turn your debt over to the Department of Education, which can seize your tax returns, your wages, social security, etc etc etc.

Get 'im, Tiffany!

"The education budget was cut?" Bush responded. "Say it again. What was cut? At the federal level?"

She repeated the question and clarified that she was referring to student loans.

"Actually," Bush finally said, "I think what we did was reform the student-loan program.

"We're not cutting money out of it. In other words, people aren't going to be cut off the program. We're just making sure it works better."...

"Students and their parents will be paying their loans back at higher-than-market rates so that the government can pay for tax cuts for the very rich," said Luke Swarthout of the State Public Interest Research Groups' Higher Education Project.

Colleges Say New Grant Program Sucks

They give extra cash to Pell-eligible students (ie lower income) but only if:

--They maintain a certain grade point average (confusing the relationship between merit and need-based aid).

--They attended an "academically rigorous" high school. That lets out a huge proportion of poor students. And creates a new federal role in governing high school curricula.

--They go to school full time. Most lower-income and community college students go part time.

--They are American citizens. Guess which age group in this country contains the highest proportion of immigrants?

Monday, January 23, 2006

New York State Cracks Down on For-Profits

Sunday, January 22, 2006

Michael Males& Boomergeddon

I found his work and talking with him extremely helpful for my own book, and I'm coming to speak to his class in Santa Cruz next month.

He sets aside the pile of papers he is grading in his apartment near UC Santa Cruz, where he teaches. The street below bustles with young people, but they're not the issue—teenagers' markers of trouble have been declining for decades.

| |

Hometown Paper

Overall, I thought Carla Blumenkranz' review was pretty fair, in that she brought up a lot of the obstacles I struggled with while writing the book. Once again, she acknowledges that the basic argument of the book is valid, while attacking me as the messenger:

It's not that Kamenetz's arguments are off base—higher education is in fact more difficult to finance than it was before the '90s, when student loans largely replaced federal student grants; freelance and temp jobs are indeed what most companies offer, given their newly discovered efficiency. It's just that, as a recent Yale grad, Kamenetz is uniquely unqualified to expound on these developments.

Be that as it may, now I am committed to these issues and I have to do my best to represent them, whether or not I was the perfect choice. I honestly only hope that whatever negative attention I draw by being an Ivy Leaguer, naive, overeager, etc...will only get translated into more attention onto the issues, which are real.

She was totally wrong about one thing though. When I talked about my bagel job, I was specifically dismissing the idea that those of us who work minimum wage jobs in a casual way (almost everyone middle class) know anything about the experience of those for whom that is their life.

p.83 :

As I say in the next graph after writing ' I was a minimum-wage retail slave,'(irony, by the way),

"Almost every American I know has low-wage memories like these. It's an American rite of passage to wait tables or bartend, babysit or work construction during your formative years. But generalizing from one's own experience can be deceptive. ... most minimum wage jobs provide income to those who really need it."

Thursday, January 19, 2006

Interesting Perspective

Yes, it isn't that the information in Strapped and Generation Debt is wrong. By this logic, the information simply does not warrant an exposition because the hardships facing young people today are facing older Americans as well; the hardships are so rampant, so obvious, so self-evident that to read about them induces ennui; and, most revealingly, the hardships faced by young people today are not unique and have in fact been a defining feature of American capitalism for generations.

Gross suggests that the problems confronting youth are a fact of life, growing pains in a bootstrap society, and that objecting to them is "whining." Our parents and grandparents had it rough; why should young people--or our children and grandchildren, for that matter--have it any easier? This sort of logic in fact defies human progress if taken another short step. Why should the lives of our children be any easier or more fulfilling or healthier or longer than ours?

Jews on Alito

While Alito's record and positions on key issues were of concern, activists said they took his confirmation, which is scheduled to come up for a vote in the Senate on Jan. 23, as a foregone conclusion.

Many said they, and the country, simply were preoccupied with other issues, from the congressional leadership shakeup to lobbying scandals to Israeli Prime Minister Ariel Sharon's health crisis.

"I don't think it's on people's minds at all," said Anya Kamenetz, an associate editor at Heeb Magazine and author of "Generation Debt," a new book. "People are consumed with Jack Abramoff and Tom DeLay."

Wednesday, January 18, 2006

Newsweek's Question

Or will they steamroll over another generation's youth to maintain the lifestyle to which they have become accustomed?

Tuesday, January 17, 2006

Gen Debt Asia

In the last four years, about 500 young people between the ages of 30 and 40 were made bankrupt each year, due mainly to credit card debt.

Credit counsellors call this group of debtors the "new poor" in Singapore. They earn more than the bottom 20% of the population but after deducting their loan repayments, their remaining disposable income sometimes puts them in dire situations.

For an in-depth look at this issue, catch "Generation Debt," the next episode of Get Rea! on Wednesday January 18 at 8.30pm on Channel NewsAsia.

In Japan they call them NEET (not in education, employment or training) (Thanks to Marc S. for the link); a British story here.

Monday, January 16, 2006

Scene of a Crime

Our Friends in Japan

The rate of "school refusal" (kids who skip school for one month or more a year, which is sometimes a precursor to hikikomori) has doubled since 1990. And along with hikikomori sufferers, hundreds of thousands of other young men and women are neither working nor in school. After 15 years of sluggish growth, the full-time salaryman jobs of the previous generation have withered, and in their places are often part-time jobs or no jobs and a sense of hopelessness among many Japanese about the future.

Also, this is a society where kids can drop out. In Japan, children commonly live with their parents into their 20's, and despite the economic downturn, plenty of parents can afford to support their children indefinitely - and do. As one hikikomori expert put it, "Japanese parents tell their children to fly while holding firmly to their ankles."

One result is a new underclass of young men who can't or won't join the full-time working world and who are a stark counterpoint to Japan's long-running image as a country bursting with industrious salarymen. "We used to believe everyone was equal," said Noki Futagami, the founder of New Start. "But the gap is growing. I suspect there will be a bipolarization of this society. There will be the group of people who can be in the global world. And then there will be others, like the hikikomori. The ones who cannot be in that world."

Spying on Undergrads

How to Avoid Student Loan Debt...

Another great link from the US PIRG Consumer Blog gives some interesting context to my last column, about the decline of the direct loan program.

Sunday, January 15, 2006

Student Loans as an Industry

If you'll forgive a digression into policy/philosophy land.

It's not that I think that the interests of industry can't intersect with the interests of individuals. As customers, we all benefit from the revolutions of price, choice, and service that have come with the corporate growth and intensified competition of the last half-century. And yet allowing a private company, Sallie Mae, to have such a strong hand in setting education policy (determining who will get money to go to college, how much they will get, at what rates and under what conditions) seems to me contrary to the growth of our economy (students as human capital), the aims of government (students as citizens), and the ideals of our society (students as human beings with free will and aspirations).

Friday, January 13, 2006

Intern Hell

I don't actually hate boomers, but

Check it out.

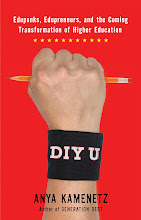

What originally inspired you to write "Generation Debt" ?

AK: My political awakening came literally the morning after the 2000 election when I, age 20, realized I'd probably spend most of my adult life dealing with the foolish, shortsighted or just plain evil decisions of the generation before us, like [WHICH WERE VERY SOON DEMONSTRATED TO BE ISSUES LIKE] deficits, global warming, and the war against terrorism.

The 300 Millionth Baby

"The new baby is symbolic of America's new multi-ethnic demography of the 21st century, both urban and suburban, that will filter out from gateway cities like L.A., Dallas and New York, as white suburban boomers fade into the past," he said.

"The baby who's born this year, as they grow up, they may not know what we mean by diversity," Mr. Haub said. "And somewhere along mid-century the word majority will disappear."

Everyday Low Prices...on health care

It's satisfying and symbolic to single out the nation's largest employer for some accountability this way, but this problem needs more than a piecemeal approach.

Thursday, January 12, 2006

Generational Warfare?

Another Piece Calling Out Boehner et. al

Why on earth would the government, in a time of unprecedented cutbacks in social spending, want to squash the cheaper direct loan program in favor of the more expensive subsidized loan program? Why would students be made to take the brunt of these cutbacks when both ends of the political spectrum agree that a better-educated workforce is essential to America's future competitiveness? Well, you could ask Terri Shaw, the head of the Office of Federal Student Aid in the Department of Education, which administers both programs. She spent most of her 22-year career working for Sallie Mae. Or you could ask Rep. Boehner, who received $136,470 in contributions over the last election cycle from members of the student loan industry, $22,375 from the Sallie Mae PAC alone. Or Rep. Howard ("Buck") McKeon, also of the House Education and the Workforce Committee, who got $77,750 from Sallie Mae. But you probably wouldn't get a straight answer from any of them.

CORRECTIONS: Luke Swarthout of the PIRGs says the $5800 figure, which I quote in the piece, is no longer viable because it pertains to the House bill, an earlier version. Also, the interest rate hikes from variable to fixed were apparently already in the law. I have asked Tom Paine to make the corrections online.

Great Piece on SL Legislation

The federal student-loan program has been an open-pit gold mine for banks. The taxpayers guarantee the companies against both deadbeat borrowers and risks posed by rising interest rates. Uncle Sugar even offers a free hedge against changes in interest-rate spreads that could harm the lenders' bottom line. (Other businesses must go to Wall Street and pay for such services.)

"In American history, this is the most outrageous giveaway ever extended by the federal government to private lenders," says Barmak Nassirian, associate executive director of the American Association of Collegiate Registrars and Admissions Officers.

Wednesday, January 11, 2006

Seems Fair

And perhaps the financial hardships of the '10s and '20s?

Spin from Spellings

Laurie, from Richmond Virginia writes:

As a graduate student, I would like to know how cutting educational loans will strengthen the country. I realize that I am only a nurse, but I do not understand how cutting funding for the elderly and disabled and students will benefit our economy. Wouldn't cuts for special interest groups be more beneficial?

Margaret Spellings

Thank you for your question. The so-called cuts you have heard about in the news are cuts to special interests, not to students. No student will have their aid cut next year because of these very necessary reforms, and in fact more money will be made available by the Federal Government for student aid.

The Department of Education continues to work to make sure that all students in America have the opportunity to go to college. This year's budget included important reforms to the student-loan programs. These reforms included reducing unnecessary subsidies and payment to lenders, guaranty agencies, and loan consolidators. The fees a student pays when taking out a student loan will be eliminated over the next several years and students will be able to borrow more money if the need arises.

According to the state PIRGs, "Rather than cutting lender subsidies, the bill derives approximately 70% of its savings from higher loan interest rates for borrowers and redirecting excessive student and parent payments to private lenders."

Tuesday, January 10, 2006

A More Elegant Response to Mr. "Moneybox"

Subject: You're a Very Mean Man

Dear Mr. Gross,

My book is not a memoir. You do it a disservice to treat it as such. I would hope that as a woman I would finally be beyond the position of being judged by my husband's job.

I say in the first chapter exactly how lucky I know myself to be. At least half of the people in my book are not "poor, self-pitying upper-middle-class types" like me but in the 72% of 25-29-year-olds with no bachelor's degree. Your piece has absolutely nothing to say about the actually poor kids, who are holding down the vast majority of minimum wage jobs while struggling to get through school, not to mention fighting in Iraq, but my book does have a lot to say about them. Perhaps you didn't have room to acknowledge more than one good point of evidence ("Now, today's twentysomething authors are clearly onto something...") in your quite amusing review?

----

Thanks for your note. A few points I'd make in response. One: I don't think I'm a very mean man.

Also, I don’t know quite what to make of the people who have chosen to consume when they had no capacity to consume, like Stella, who maxed out her Citibank Visa by taking a trip to San Diego on her semester break from college, or Kyle, the Cornell grad who chose to have a car in college and hence took our more loans.

I know you probably thing I’m just a mean old man. But we actually have quite a lot in common. I, too, am the child of an English professor of modest means. I worked my way through Cornell, on student loans and crap jobs, then landed a year-long benefit-less internship at the New Republic for $200 a week while living in a shithole rowhouse in a part of town to which none of our girlfriends would venture, and then did two years of graduate study at Harvard, living on about $10,000 a year. My first job in journalism, which I took with my stellar degrees and experience at TNR was the ultimate crap job – coming in at 4:00 a.m. to Bloomberg news to summarize newspaper articles for the wire service and living in a shitty apartment. Of course, like everybody else, there were times when I was miserable and full of self-pity, and I even wrote about it sometimes.

I quit Bloomberg after nine months, and have been self-employed ever since, writing for magazines, writing books, etc. The point is not to impress you with my up from the bootstraps tale, or to look back wistfully to my youth. The point is that if you want to make it big, or relatively big, in New York journalism at a young age you have to take an awful lot of risks – which is precisely what you’re doing. At any point in my mid-20s, I could have taken a job with benefits, a 401(K), and a paid vacation at a crappy trade publication, or at the Daily News. I chose not to, because I thought I was capable of better and was prepared to deal with the insecurity for the sake of doing more interesting and satisfying work. I’m guessing you’re making the same calculation—and you’re right.

---------

Dear Mr. Gross,

Thanks for writing me back. Since you concede the main thesis of the book--

" College is more expensive today in real terms. There's been a shift in student aid—more loans and fewer grants. The Baby Boomers, closer to retirement, are sucking up more dollars in benefits. There's more income volatility and job insecurity than there used to be"--

I'm going have to declare victory on this one. I just wish I could get you to see that I didn't write it about me and my own choices. I'm lucky as hell to be doing what I'm doing.

By the way, if we have so much in common, why is it that you find me so especially annoying?

Monday, January 09, 2006

Crappy Companies--Crappy Jobs

Saturday, January 07, 2006

Feds Want their money-Now!

"He's a productive part of society, and you want to beat him down? It's sickening," said Cal Lincoln, a former boss. "Leave him alone."

Friday, January 06, 2006

Pension Pain

it would freeze pension benefits for its American employees starting in 2008 and offer them only a 401(k) retirement plan in the future.

Under 35? You're probably never getting a pension.

Thursday, January 05, 2006

Words from The New Republic

(By Adam Kushner)

I'm reading my friend Anya Kamenetz's Generation Debt in galleys right now (it comes out in February, but you can pre-order on Powells.com), and I'm scared stiff. Kamenetz retreads some familiar, if frightening, ground about young people and Social Security, jobs, and health insurance, proposing some sane liberal solutions. But, as a twenty-something myself, her most interesting--and most terrifying--reportage shows that people of my generation must begin their careers with mountains of debt unlike what any other generation in American history has contended with. Average student loans from four-year colleges are approaching $20,000 (grad students average $46,000, law and medical students around $100,000), and these debts are creating social ripple effects: They're influencing young people's decisions about careers, when to marry and have children, how and when to buy houses and cars, and when to borrow from their families.

Mother Jones Review: "Sometimes Brilliant"

They got the subtitle wrong, but that's cool.

Faced with lingering loans and credit card bills, too many young people feel they must, as one young grad tells Kamenetz, “go through your life doing something you don’t want to do…. If your only option is taking out loans, it sucks you right back into the system.” For me, the American Dream is still alive—it’s just under the table, hiding out from Sallie Mae and Citigroup.

I'll take $1,000,000

"The idea is simple: to try and make $1m (US) by selling 1,000,000 pixels for $1 each. Hence, 'The Million Dollar Homepage". The main motivation for doing this is to pay for my degree studies, because I don't like the idea of graduating with a huge student debt. I know people who are paying off student loans 15-20 years after they graduated. Not a nice thought!"

Eretz Halav u'Dvash

Monday, January 02, 2006

Trashing Teens

2005 saw a spate of alarmist stories trashing teenagers for sex, drug and booze abuse. The New York Times even upgraded the concern to a new “identity disorder,” in which teens are increasingly using illicit drugs, alcohol and sexual activity to remove themselves from reality. Don’t believe the hype. According to the University of Michigan’s long-term “Monitoring Our Future” study, sexual activity, drug abuse and alcohol abuse among teens are all down in recent years.

Generation Debt: Movie Star Version?

By the end of 2005, what just a year earlier had looked like the start of an upward climb toward Hollywood stardom began instead to read like a cautionary tale about the difficulty of minting movie superstars from the ranks of a 20-something generation.

Stardom came easier to the young only a decade or two ago. At 23, Tom Cruise grasped it with the release of Top Gun in 1986, and flaunted it two years later by turning a vehicle as slight as Cocktail into a major hit. Julia Roberts was a superstar at 22, after the success of Pretty Woman in 1990, and Leonardo diCaprio was just 23 when Titanic turned him into an international screen presence in 1997.

All quickly rose into Hollywood's top salary tier - the ranks of the $20 million actor, or thereabouts - and achieved bankable status with nervous executives who were willing to make a costly film because these actors were in it.

That kind of glitter has remained out of reach for Mr. Bloom's generation...Sunday, January 01, 2006

The Subsidy that Refused to Die

Only 38 percent of Female Harvard MBAs are working

"Great as liberal feminism was, once it retreated to choice the movement had no language to use on the gendered ideology of the family. Feminists could not say, “Housekeeping and child-rearing in the nuclear family is not interesting and not socially validated. Justice requires that it not be assigned to women on the basis of their gender and at the sacrifice of their access to money, power, and honor.”"

I disagree that housekeeping and child-rearing are a priori boring, but I agree with the rest of the statement.

Here is the Generation Debt angle. Women are making up significant proportions of classes at elite colleges, graduate and professional schools. They have all the student loan debt that goes with that, but if few of them end up in the full-time workforce, they won't have the same earnings to pay it off. As the education finance crisis continues, how long before women start to receive a lower proportion of the scarce aid available? How long before they stop going to school at all?

A private student loan company I am writing a story about calculates loans based on a students' expected future income. That would probably mean that they loan women money at worse rates than men, because the risk is higher.

PS: Today's NYT Sunday Styles section features an anguished personal essay on the same question.