Friday, December 21, 2007

OPPORTUNITY MAINE NAMED AMONG ‘TEN BEST POLICIES’ IN THE NATION IN 2007

Now the Drum Major Institute has named Opportunity Maine, conceived by a team of student and citizen activists including the League of Young Voters and former USM president Andrew Bossie, one of the ten best progressive policies of 2007.

" Talk about killing two birds with one stone: with an innovative new program called Opportunity Maine, the Pine Tree State is simultaneously addressing the mounting burden of student loan debt and the economic development challenge of retaining an educated workforce."

Congratulations guys!

Wednesday, December 19, 2007

Yahoo Column on Credit Cards

While overall the ratings were quite positive (3 1/2 out of 5),

Negative reactions were interestingly split between those who thought the advice was too basic, those who complain you don't need credit cards at all, ("Why MUST we use debt ever? ") and those who call me a man. (my favorite: "Man-ya").

For those who think the advice is too basic: When the average household credit card debt goes below $8000, this advice can be retired.

For those who think that you don't need credit cards at all: You're right. Unfortunately, my editor asked me to soften my recommendation that you don't carry debt and pay off the balance every month.

For those who think I am a man: You're right. I am the first transsexual personal finance web celebrity. You heard it here first.

Sunday, December 16, 2007

Writeup in Times Business Section

I OWE, I OWE

The article in Fast Company on Mint, a Web site that focuses on young adults who need help in managing their money, is worth reading for quotations like this from the 26-year-old founder, Aaron Patzer: “Your parents say ‘balance your checkbook,’ but you don’t have to anymore,” thanks to all the online tools available.

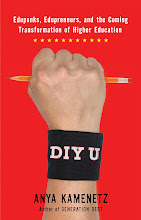

But what is more compelling are the statistics that the author, Anya Kamenetz, has included in the article. Consider these:

¶On average, “Americans under 35 spend 16 percent more than they earn.”

¶The median household income for people under 34 in 2005 was $48,405. From 2000 to 2005, that figure fell nearly 6 percent, according to the Census Bureau.

¶The average credit card debt for college seniors in 2005 was $2,864.

“This demographic, in sum, is sorely in need of an easy-to-use solution to their ample money woes,” Ms. Kamenetz writes. That explains why a number of money-management Web sites — Geezeo, Spendview and Wesabe among them — have started recently.

Friday, December 14, 2007

Permalancers, Unite!

Viacom, a Fortune 500 media company, had $11.5 billion in revenue last year. It includes the hip, youth-oriented cable networks MTV, VH1, Comedy Central and Nickelodeon. But the cachet of these names on a young college graduate's résumé is not matched by the way the company treats its workers.

Like scores of companies in the media industry and elsewhere, Viacom has increasingly shifted to workers who are not regular, salaried employees--both true freelancers and "permalancers." The term refers to those who may work full-time for several years--with duties, hours, and responsibilities very similar to regular employees--yet who are classified as temporary employees or independent contractors and do not receive the same recognition as regular employees.

Thursday, December 13, 2007

Income Gap At Its Most Grand Canyon-est Ever!

*Income inequality among households, both before and after Federal taxes, grew more quickly over the last two years of the series, 2003-05, than over any other two-year period on record, back to 1979.

*If we break households in groups of 20% each by income, well over half of household income (55%) was held by the richest fifth in 2005, the highest such share on record.

Tuesday, December 11, 2007

MTV and the Permalance Debate

writers, Broadway stagehands, and now MTV "permalancers."

The walkout highlighted the concerns of a category of workers who are sometimes called permalancers: permanent freelancers who work like full-time employees but do not receive the same benefits.

Waving signs that read “Shame on Viacom,” the workers, most of them in their 20s, demanded that MTV Networks reverse a plan to reduce health and dental benefits for freelancers beginning Jan. 1...

But some of the protesters asserted that corporations were competing to see which could provide the most mediocre health care coverage. Matthew Yonda, who works at Nickelodeon, held a sign that labeled the network “Sick-elodeon.”

“I’ve worked here every day for three years — I’m not a freelancer,” Mr. Yonda said. “They just call us freelancers in order to bar us from getting the same benefits as employees.”

Gawker has prime coverage. Yes, that Gawker.

Monday, December 10, 2007

Krugman on Subprime Bailout.

"There are, in fact, three distinct concerns associated with the rising tide of foreclosures in America.

One is financial stability: as banks and other institutions take huge losses on their mortgage-related investments, the financial system as a whole is getting wobbly.

Another is human suffering: hundreds of thousands, and probably millions, of American families will lose their homes.

Finally, there’s injustice: the subprime boom involved predatory lending — high-interest loans foisted on borrowers who qualified for lower rates — on an epic scale. The Wall Street Journal found that more than 55 percent of subprime loans made at the height of the housing bubble “went to people with credit scores high enough to often qualify for conventional loans with far better terms.”"

Paul Krugman says the administration's subprime mortgage plan will help investors some, homeowners a little, and predatory lending victims specifically not at all.

Friday, December 07, 2007

One Week Job, Part 2

" I am a bit tired of hearing about the pangs of these so-called 'new Millennials' and their hesitancy to join the working class. I am especially irritated by authors/journalists (Dr. Twenge comes to mind), who have created this buzz in the corporate world intimating we have to learn how to deal with and accommodate them in the workplace! There is no difference in what they are feeling now than what my grandfather and his father felt back then."

Many others chime in with varying degrees of derision for those so young and foolish as to wish for/ dream of / expect a happy time working at a fulfilling job.

Yes, attitudes have changed among young people. But the workplace has changed too. I wonder how those who bash the Millennials reconcile that image of them as privileged and coddled, with the fact that, every time they walk into a McDonald's, a Starbucks, a Target, a Circle K, a Best Buy, a Blockbuster, a Whole Foods, a Barnes&Noble, a restaurant, a bar, 90% of the workers who greet them are under 30. Half of all minimum wage workers are under 25.

These workers may not be white. They may be immigrants. But they represent this generation too, and they are getting "real work experience" in spades. A plurality are college students or even college graduates.

The difference between these service jobs and the factory jobs our grandparents found is that the salaries are much lower and you can't raise a family on them. So they can't be long term commitments.

Millenials are far from "hesitant to join the working class." They ARE the working class.

Subprime Mortgages: Tip of the (melting) Iceberg

Other types of consumer debt, which have nothing to do with housing and nothing to do with subprime, are going bad, too.

Even as the economy continues to expand, more and more borrowers are having difficulty remaining current on their debt. Which isn't surprising, given that median household income hasn't budged since 1999 (see Figure 1 on Page 4 of this Census report). What's more, in a natural reaction to reckless lending, mortgage companies and banks are now in money-hoarding mode and thus unable or unwilling to help Americans refinance existing debt.

Thursday, December 06, 2007

Credit Cards: What Happens Now?

We're all connected. Everyone is going to suffer when the hangover from excess credit finally comes due. The subprime mortgage lending compromise announced today isn't going to do enough to keep people in their homes, which means it isn't going to save the portfolios of Goldman Sachs et al. Same is true, eventually, in the credit arena.

The brilliant Elizabeth Warren on Marketplace last month: What about the economy in all of this? We're often told that consumers are responsible for about two-thirds of Gross Domestic Product. Now if they start pulling back, what can we expect?

Warren: This is one of the scariest parts for me. The typical family is carrying now about two months' worth of income in credit card debt. So what's going to happen long-term? Do we have a period where all these families that are carrying all this debt simply cut back on their consumption so that they can pay off the outstanding debt loads? Is that gonna be a long, slow decline, or is it going to be a one-time smack? Either way, the consequences for the economy cannot be good.

Wednesday, December 05, 2007

Yahoo Column: Liberal Rambling

Here's my favorite Yahoo comment. Should provide a good incentive to flee the country:

Jus more multicultrial (sic) liberal rambling. Way to go naming a few places where Islamo terrorist are just waiting to kidnap an American or blow up a night club! Here is a better idea for the liberal types, how about spending your money in the US and visiting the many fine Cities, National Parks, and other destinations in the US first. A national outlook is more important than a Global outlook for young people. Seems the liberals are the first ones to run overseas and throw thier money away but the first ones to complain about the national enonomy and limited job opportunity. Seeing what the US has to offer might open your eyes as the why everyone else in the world wants to live here and why so many illegals are breaking into the country everyday.