Thursday, February 28, 2008

An Economic Compact for the Young

"For a quarter-century, policies that once promoted entry into the middle class, such as affordable college tuition and support for first-time homeownership, have been battered by ideological and fiscal assault. Social investment has not kept up with changing social realities, and the remnant of America's welfare state is tilted toward the other end of the age spectrum. The solution is not, as some have suggested, to remove supports from the elderly. Reliable pensions and Medicare are also on the defensive. The remedy is to enlarge social investment for the young, to expand economic pathways to secure adulthood. With the exception of the generation born between roughly 1880 and 1910, whose members lost so much as adults in the Great Depression, there has never been an extended period of generational downward mobility comparable to this one -- and it is all the more remarkable for occurring during a period of general economic growth. "

NPR tomorrow

Wednesday, February 27, 2008

Today's Column: Investing Basics

I just don't think it's a good idea to chase double digit returns with the money you need to retire on. There are plenty of safer investments out there.

If I can speak personally for a second, I think of money as a major responsibility. I want to consume and invest my resources in a way that's going to maximize happiness for myself, my family, my community, and the planet. That's a lot of work and I screw it up in big and small ways every day. And making money decisions is only one part of life--you need to leave time for actual work, fun, friends, family, exercise, education, spiritual life, etc.

Or in the words of the Notorious B.I.G: Mo' money, mo' problems.

Thursday, February 21, 2008

The Culture of No Roots

"Living on money from the odd grant, temp jobs and teaching positions, she is emblematic of her Gypsy tribe — theater people are the original urban nomads — and a vivid example of the increasingly precarious domestic life of an artist trying to live in New York.

Rent for a studio or a one-bedroom in the East Village, for example, has more than doubled in 10 years, said Douglas Hochlerin, a broker with Bond New York, a firm specializing in Manhattan rentals. Last year, when the rent on Ms. Berman’s Mott Street one-bedroom, where she had lived for three years, rose to $1,550 from $1,350, she gave up her lease, beginning another bout of itinerancy, as she described it.

“It’s all about money,” Ms. Berman said cheerfully. “It’s not like I have a penchant for the transient life.”

According to Emily Morse, the director of artistic development at New Dramatists, “two major things have changed as far as this city is concerned: the real estate market and the fact that very little money is going directly to artists.”

She continued: “You used to be able to work a 20-hour week, pay the rent on your tiny studio, and still write your plays. That’s no longer possible.”

Starve your artists and you get starving art.

Tuesday, February 19, 2008

PS from Paul Krugman on Poverty

Mainly, however, excuses for poverty involve the assertion that the United States is a land of opportunity, a place where people can start out poor, work hard and become rich.

But the fact of the matter is that Horatio Alger stories are rare, and stories of people trapped by their parents’ poverty are all too common. According to one recent estimate, American children born to parents in the bottom fourth of the income distribution have almost a 50 percent chance of staying there — and almost a two-thirds chance of remaining stuck if they’re black.

Friday, February 15, 2008

"American Dream"? Failed Journalistic experiment?

A guy decides to start his life over with nothing. After ten months he has moved from a homeless shelter into an apartment, bought a pickup truck, and had saved close to $5,000. Not surprisingly, he then wrote a book about his experiences which he holds up as "a testament to what ordinary Americans can achieve."

Adam Shepard, if you really want to show just how easy it is to get out of poverty with a little gumption, I suggest immigrating to a country where you don't speak the language. Then maybe the playing field would be a little more level.

Thursday, February 14, 2008

WSJ: Obama is a Downer

"Sen. Obama is selling ... deep grievance over the structure of American society... selling the revolution -- change "from the bottom up."

This is the best argument for Obama I've yet heard. I have felt inherently distrustful of his charms and his rhetoric, but I think Henninger underestimates how many people feel that same grievance.

Wednesday, February 13, 2008

Clock is Ticking for American Spending

1) the Wall Street Journal finds a) a rise in credit card delinquencies but b) an "abrupt slowdown" in new borrowing. People are getting in over their heads and they are saying "enough"--banks are tightening borrowing standards to stop the overdrawn from getting new credit.

2)Robert Reich's excellent editorial in the Times. "three decades during which American consumers have spent beyond their means" are "now coming to an end. Consumers have run out of ways to keep the spending binge going."

His solution: raise the income of the "bottom" two thirds of Americans, which has been flat for a staggering 35 years, during which the plums of economic growth have gone to the top 5 percent. Do this through redistributive taxes/income credits, more unions, better schools. He calls this "The only lasting remedy, other than for Americans to accept a lower standard of living and for businesses to adjust to a smaller economy."

As Yahoo commenters often point out, I am a big old commie and therefore predictably in favor of more unions, more redistributive taxes, and better public schools. But I think the latter option is not so unthinkable. A "lower" standard of living, meaning one where enough is enough, one not based on constantly increasing consumption and hours of work,

is exactly what this planet needs. A "smaller" economy, in terms of energy and material inputs, is absolutely necessary for our species' survival.

Latest Yahoo Column: Upside of Downturn

Thursday, February 07, 2008

Bummer, Private Loans Bankruptcy Discharge Didn't Pass

“The College Opportunity and Affordability Act contains a meaningful nucleus for private student loan reform. However, given the lessons of the subprime mortgage crisis we must provide basic protections for student loan borrowers in bankruptcy. We are disappointed that the House chose to stand with big banks instead of students who fall victim to predatory private student loans.”

Even More from the Youth Rights Movement

We hope that this idea would get some tread throughout the country if New York City could take the lead. Recently Austria has lowered the vote nationally to 16 and there are movements in France and England as well.

To the Editor:

Re "You're 16, You're Beautiful and You're a Voter" (Op-Ed Feb 6)

Enfranchising youth at 16 through the vote is a civic mission important to accomplish now. All research shows that in order to build an active citizen it is necessary to begin during the high school years when young people are attached to their schools, living at home with their parents and still residing in their communities. I agree with Anya Kamenetz on how important it is to tie the 16 year old vote to civic education. Arguments against lowering the voting age would be substantially lessened with civics training and we would grow a more conscious electorate and strengthen our democratic process.

In New York City there is a current intro bill in the City Council to lower the vote to 16 in local and municipal elections. There are also efforts being made to allow 16 year olds to have a vote on Community boards, Youth Boards and Educational Committees. This election does show clearly that young people want to be in the process but need the right vehicles to bring them on the scene. Enfranchisement of 16 year olds is the last "civil rights movement" in America.

Francine Baras

Diane Graszik

New York, NY Feb.6, 2008

Ms. Baras is executive director of Future Voters of America

Ms. Graszik is an associate executive director of Future Voters of America

Response from the Silver Haired Tsunami

My dad wrote:

I mean the only thing I didn't like about the piece was the reflex knock against old people. There's no evidence really that their judgment is worse than anyone else's necessarily and I think on principle it's as bigoted to slam people just because they are old as it would be to slam them for belonging to any particular group.

The prejudice in our society against the elderly is very ahistorical and weird in human history.

I replied:

That's not a reflex knock. It's a fact. As the population gets older there are going to be more night blind drivers on the road. More lonely isolated people who fall victim to financial [and other] scammers.

I am advocating NOT treating people differently just because they reach a certain age, but looking at people as individuals for what they are able to to do. Testing is a crude way to do this, but one way to introduce the concept that it's level of ability, not calendar year, that matters.

How do we protect people while preserving their independence? Security vs. freedom--the classic democratic conundrum.

More on Youth Rights

House Legislation to Reform Student Loans, FAFSA

"Today the House of Representatives will vote on the College Opportunity and Affordability Act. The legislation contains several important policy changes to reform private student loan policy, critical grant programs and lower the cost of textbooks. In addition the House will vote on an amendment to provide private student loan borrowers with basic bankruptcy protections."

On private student loans, they're addressing the problem that students and parents don't understand that these loans have higher interest rates and less borrower-friendly policies than federal education loans.

--Lenders must inform students "clearly and repeatedly" that private student loans are more expensive than federal student loans, and that all federal eligibility should be exhausted before taking out the private loans.

--Ban "co-branding" of private student loans (where a college cooperates or shares revenues with a private lender, or a private lender uses the "name, emblem, mascot, or logo" of the college.)

--Require schools to certify all private loans to avoid over-reliance on these loans. School oversight was very successful in reducing reliance on private loans at Barnard and other schools.

Just as important, if not more so, is bankruptcy protection for private loans after five years in repayment.

"Representative Danny Davis’s amendment ends an unfair policy of special bankruptcy treatment for lenders who saddle students and their families with high-risk, high-cost private student loans. Over the past decade private, non-federal student lending has grown significantly. These loans are more expensive, have more stringent repayment requirements, and provide fewer protections than federal loans. Moreover, private student loans exacerbate student indebtedness because they provide the worst rates and terms to those students with the greatest financial need. This result directly contradicts the public policies underlying the federal student aid system, which attempts to place a college education within reach of low and middle-income students. The Davis amendment would allow borrowers to discharge their loans in bankruptcy after five years in repayment."

Wednesday, February 06, 2008

Generation Dead

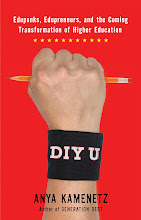

The book's been out in paperback for a year now. I'm still writing a biweekly Generation Debt column for Yahoo! Finance, and I still travel and speak about 12 times a year-- mostly on campuses, on topics like credit cards, student loans, generational politics, personal finance, the changing job market, health care and higher education policy. But I've always had other interests, and I'm feeling a little stifled by the scope of this blog.

I feel a need to start writing and speaking more openly about the issues I really care about. I was just hired by a bunch of really smart people to write about social entrepreneurship, sustainability, technology, culture, and design in the context of business and our changing economy, and I am psyched. I want this blog to serve as a notebook and a reminder of the bigger picture beyond the day-to-day stories.

Andrew Leonard, one of my favorite bloggers, put it well in a post today: "The economic, social and political model of the U.S. has developed serious albeit remediable flaws and needs major surgery." True, and arguably true of civilization as a whole.

G-d willing, most of my life will take place in the 21st century. I am so fascinated by how much has to change in my lifetime. We have to adopt a new energy economy with hopefully a new set of social relations to go with it. We have to mitigate and adapt to the environmental degradation and climate change that is already occurring. We have to adapt to a country that will be older and grayer. And as Americans we have to abandon this dead-ender militarism and accept our place once and for all as a member of the international community, not the sole superpower. But when we look to the new, rising global powers --- India, China, Brazil, (some say Russia)--every single one of them has horrific poverty, terrible infrastructure, even worse environmental problems, and rickety, or non existent, civic institutions.

It's scary. It's easy to get into crisis mode and shut down all thinking. But as I realized after Hurricane Katrina, pessimism is a luxury. As Nachman of Breslav said,

All the world is a very narrow bridge. The most important part is not to be afraid.

More from the Youth Rights Movement

I heartily agree. I just want to make contact and introduce myself/my group. I run the National Youth Rights Association, a largely youth-led group that campaigns for lowering the voting age, lowering the drinking age and many other adult rights that are currently denied to young people. We're small but growing. We've had some great press coverage and a few good local campaigns.

The recommendations you made in your piece sound a lot like Robert Epstein's. Have you read his book, The Case Against Adolescence? NYRA is big fans of both Epstein and Mike Males (who you might also know). I, and our members, are all very glad to have your support.

Thanks again for writing that great op-ed. Check out the NYRA page here: http://www.youthrights.org

Alex Koroknay-Palicz

Executive Director

National Youth Rights Association

The Case Against Adolescence

Dear Ms. Kamenetz - I've received 3 emails so far this morning about your op-ed piece in the Times, saying, more or less, "It sounds like she's rehashing your new book." This is indeed frustrating, given that this book involved more than nine years of research on my part. As you can easily determine online, I'm also working on a book called The Ageless Society, arguing for competency-based assessment across the lifespan. Please see:

http://TheCaseAgainstAdolescen

http://HowAdultAreYou.com

http://en.wikipedia.org/wiki

Sincerely, /re

Robert Epstein, Ph.D.

Contributing Editor, Scientific American Mind

Visiting Scholar, University of California San Diego

Host, Psyched!® on Sirius Satellite Radio (LIME, Channel 114)

Director Emeritus, Cambridge Center for Behavioral Studies

http://TheCaseAgainstAdolescen

http://TheEpsteinBlog.com

http://DrEpstein.com

What Can Young People Do?

We should hasten the enfranchisement of this generation, born between 1980 and 1995, by lowering the voting age to 16.

Age thresholds are meant to bring an impartial data point to bear on insoluble moral questions: who can be legally executed, who can die in Iraq, who can operate the meat cutter at the local sub shop. But in a time when both youth and age are being extended, these dividing lines are increasingly inadequate.

Legal age requirements should never stand alone. They should be flexible and pragmatic and paired with educational and cognitive requirements for the exercise of legal maturity.

Driving laws provide the best model for combining early beginnings and mandatory education. Many states have had success with a gradual phasing in of driving rights over a year or more, starting with a learner’s permit at age 16. The most restrictive of these programs are associated with a 38 percent reduction in fatal crashes among the youngest drivers, according to a study conducted by the AAA Foundation for Traffic Safety.

Similarly, 16-year-olds who want to start voting should be able to obtain an “early voting permit” from their high schools upon passing a simple civics course similar to the citizenship test. Besides increasing voter registration, this system would reinforce the notion of voting as a privilege and duty as well as a right — without imposing any across-the-board literacy tests for those over 18.

And why stop at voting? Sixteen is a good starting point for phasing in adult rights and responsibilities, from voting to drinking to marriage. In reality, this is already when most people have their first jobs, their first drinks and their sexual initiations. The law ought to empower young people to negotiate these transitions openly, not furtively.

We know driving laws reflect reality; whoever heard of the scourge of under-age driving? On the other hand, studies have shown that three-fourths of high school seniors have drunk alcohol. Surveys show that teenagers who drink at home with their families go on to drink less than those who sneak beers with friends. Imagine 16-year-olds receiving a drinking permit upon passage of a mandatory course about alcoholism. The permit would allow a tipple only at family gatherings or school functions for two years — until you graduate or leave home.

The phasing in of credit cards at 16 could work with firm restrictions. A parental co-signer should be required until young applicants have made a year of on-time payments from their own wages. The most important requirement would be passing a mandatory financial literacy test. The applicant would define “compound interest,” correctly decipher the fine print on a credit card agreement and argue with a robotic customer service representative over a mysterious fee. Surely this graduated system would be safer than handing young people a $2,000 line of credit just as they leave home for the first time.

The more we treat teenagers as adults, the more they rise to our expectations. From a developmental and vocational point of view, the late teens are the right starting point for young people to think seriously about their futures. Government can help this process by bestowing rights along with responsibilities.

Tying adult rights to cognitive requirements could also smooth the path to dealing with a much bigger age-related social problem. Demographically, those over 85 are our fastest-growing group. By 2020, the entire nation will be about as silver-haired as Florida is today. We need to be able to test Americans of all ages, to make sure they’re still qualified to drive and to help them avoid financial scammers. From a public health point of view, the silver tsunami poses more of a threat than marauding teenagers ever did.

Anya Kamenetz, a staff writer for Fast Company, is the author of “Generation Debt.”