Tuesday, March 31, 2009

More Top College Spots for Rich People

They're using a few different tricks so they can still pretend to be "need blind": admitting full-tuition payers from waiting lists, or admitting more rich international students. They're profiling kids: "many of these colleges say they are more inclined to accept students who do not apply for aid, or whom they judge to be less needy based on other factors, like ZIP code or parents’ background."

The Times concludes, " the inevitable result is that needier students will be shifted down to the less expensive and less prestigious institutions."

No kidding.

Monday, March 30, 2009

New Changes to Student Loans, From Obama and Sallie Mae.

James Madison

Obama is giving it a shot: trying to make Pell Grants an entitlement and cut student lenders out of business in favor of direct loans. But these measures have been tried and defeated before. Private lenders, led by Sallie Mae, have already started to battle again this time.

What's different this time? The credit crunch.

Exhibit A: Sallie Mae's new version of private, unsubsidized student loans replaces the "signature loan" with the "Smart Option" loan. The interest on these loans must be repaid while students are still in school. This reduces the overall cost of the loan as well as shortening the repayment period (avoiding negative amortization that comes with putting off the interest payments until graduation).

But that means Sallie Mae is getting less money out of each borrower, in exchange for reducing the risk; and the in-school payments make more apparent the full cost of private loans, which are often blithely ignored by families today. If families and students can't come up with the monthly interest payments, they will be more likely to stick to government loans and grants, or make hard decisions about whether they can actually afford the tuition in the first place.

Sunday, March 29, 2009

Possible Class Action Over Hidden Student Loan Fees

I have heard about this kind of thing before--this game playing is pretty common among lenders. I don't understand how the guy is going to get satisfaction from Education Finance Partners, however.

The company is now in bankruptcy & in 2007, they had to pay $2.5 million to settle charges brought by Attorney General Andrew Cuomo over its shady business practices.

Thursday, March 26, 2009

20somethings Coping with the Recession

A familiar refrain:

"the most strangling aspect, I think, is the perception of my Gen Y e-mailers that they dutifully set up their lives based on assumptions that suddenly no longer apply."

And even more familiar:

"If I were a touch more paranoid, I would think there has been a conspiracy to systematically entrap me and my fellow graduates into an endless cycle of debt. Student loans, buying necessities on credit because the student loan payments bludgeoned my bank account, racking up greater credit card debt than student loan debt, credit scores, having children, taking out another round of loans to pay for their education, wondering if retirement is possible when Social Security is a joke."

Tuesday, March 24, 2009

Smart Growth Manifesto

I am going around delivering this message to students because I believe it's what they need to be thinking about.

20th century capitalism is eating itself. For the first time since World War II, global growth is forecast to turn negative -- and that's an optimistic forecast, relative to the possibility of a global lost decade.Today's leaders are plugging dikes, bailing out industries and banks as they fail. Yet, what negative global growth suggests is that the problem is of a different order: that we have reached the boundaries of a kind of growth.

Reigniting growth requires rethinking growth. The question Davos -- and most leaders -- are asking is: where will tomorrow's growth come from? Will it result from oil, cleantech, bailouts, China, or Obama? The answer is: none of the above. Tomorrow's growth won't come from a person, place, or technology - but from understanding why yesterday's growth has failed. The same growth models applied to new people, places, and technologies will simply result in the same crises, over and over again. We have to reboot growth: the problem is not what is growing versus what is not, but how we grow.

20th century growth was dumb. The central, defining lesson of the macropocalypse is that 20th century growth wasn't built to last. Dumb growth is unsustainable - if the world grows the same way that developed countries did, well, there won't be a world. Dumb growth is unfair: it's growth that's an illusion for many; just ask the American middle class. And, ultimately, perhaps most dangerously, dumb growth is brittle: it falls too easily into collapse, reversing many of yesterday's gains; just ask Iceland.

Saturday, March 21, 2009

Recession and Generational Psyche

For some deeper thinking on the effect of the recession on the Net Gen, I turn to Fast Company staff writer and author of Generation Debt, Anya Kamenetz. As Anya rightly noted in one of her Yahoo! Finance columns, “Economic dramas shape an entire generation’s beliefs about the nature of the economy and the risks involved.” That was a year ago and already she was postulating about how the Net Gen’s psyche might be shaped. Specifically, she noted that young people:

- Won’t expect to get rich quick.

- Will “get real” about consumption.

- Will buy on the cheap.

I spoke with Anya recently so I thought I’d ask her to elaborate on her thinking.

What effect do you think this recession will have on the psyche of people entering the workforce now?

“The climate in the last 10 years has been a very unrealistic one. We have been living in this huge bubble. For young people who are entering the 20’s now, this is really all they knew: Inflated expectations, ridiculous monthly consumer debt, and the idea that you don’t need to save for the future because you can just count on the equity in your house. But, when the bubble bursts, the paradigm shifts. For young people now, they are really looking around and seeing the world as being a very different place. For older people, it can be a lot more traumatic to have this happen, but for young people, they’re more ready to maybe accept that change.

And so, if you look at ‘The Greatest Generation’ that came of age during the depression and then entered World War II, they were able to achieve at incredibly high levels and get a great education. That legacy of the depression, obviously it was very hard for a lot of people, but it also led to realistic attitude about money, and a very practical down to earth determination to try to succeed, and some strong family-oriented values. I think that I’m starting to see the beginning of that among this generation. People are saying, ‘Well, you know, this idea of endless wealth and greed, it’s not something I really want to sign up for.’ Young people are forced to consider, at a very young age, what is really important to them and what they really want to have because they know they can’t have it all.”

So, really, this is good for us?

“From a purely economic point of view, I think it could be [good for us]. It’s a mixed bag, right? Because on the one hand, the drama that you enter into upon graduation, it actually can determine your salary for years to come. So if you start in a down market or you have to take a job that’s not exactly matching your skills, it could have a long term effect on your income. But on the flip side, if you get into a habit of saving very early, you have the magic of compound interest on your side, plus you develop lifelong healthy financial habits.”

So, in the end, a generation known for being spoiled, having unrealistic expectations about work, and graduating university with an inflated sense of entitlement might actually end up being the “sensible generation.” I would add to Anya’s analysis the notion this will be a generation that will trust corporations even less than previous generations and will be more adamant in demanding integrity from their corporate and government leaders.

And while I hope all of this is true, I also know that there is a layer of insulation between the Net Gen and the economy: their parents. The extent to which many Net Geners will feel the impact of the economy is also dependent upon how well their Boomer parents are able to weather the storm and continue to provide for adult children that may still be living in their basements. Given that many Boomers are being forced to delay retirement, I would say the insulation is getting thin. In fact, if pensions shrivel up and forced retirements put a strain on the family coffers, the Net Generation may even have their own basements occupied by Boomer parents that need caring for in old age. I’m sure there is an entire school of psychology devoted to that topic, so I won’t even get started.

Friday, March 20, 2009

Rick Steves Knows What's Up

"A headline today said, "Americans lose 18 percent of their wealth." Well, no, it wasn't real wealth, it was a bubble. You're down 18 percent? You're not. It shouldn't have been up there in the first place. So get over it. Shut up. Go to work, produce stuff that has value. I really think the days are gone, I hope, when people can rearrange the furniture and get rich on it. You got to produce something."

Wednesday, March 18, 2009

Check out DIYUBook.com For the Latest

It's book launch season!

between now and the summer I'll be blogging at DIYUBook.com, Fastcompany.com, and the Huffington Post as well as Twittering at Anya1anya.

Please come check me out at one of those places!

Anya

Monday, March 16, 2009

Thursday, March 12, 2009

Good News, Bad News: Proposed Changes to Student Loan System

1) Raise the maximum Pell Grant. Make it an entitlement (indexed to inflation +1%) for the first time. This is great news.

Problem #1: Tuition has been rising at inflation + 4 or 5%. Problem #2: Most students don't get the maximum Pell Grant. Pell Grant amounts are determined by the vagaries of the FAFSA form and the discretion of colleges.

2) Eliminate subsidies to lenders in favor of the Direct Loan program for Stafford loans. Cheaper for taxpayers. Problem: Private lenders, frozen out of the student program, will instead aggressively market private loans, which are more expensive for students.

3) Raise total subsidized loan amounts available by increasing the Perkins loan program. Problem: interest on Perkins loans is due while you are in school.

Overall problem: Raising federal tuition subsidies tends to lead to tuition increases. There are no countervailing measures to get colleges to examine costs.

Wednesday, March 11, 2009

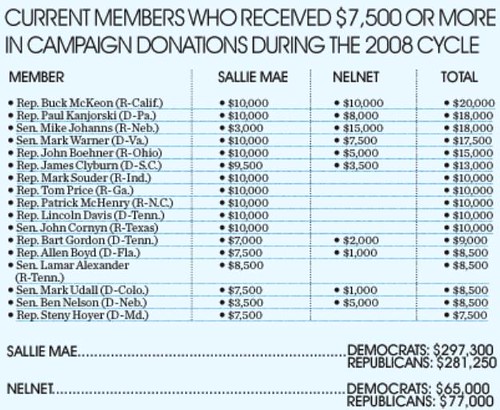

Lawmakers Take $ From Student Loan Companies, Oppose Reform

Obama wants to save money by cutting subsidies to banks and thus eliminate the FFEL in favor of Direct Loans, which are much cheaper for the taxpayer. It was tried under Pres. Clinton and failed because of political flimflammery.

These senators and congressmen, the recipients of thousands in lobbying money, oppose the idea.

Even though the entire function of a bank-provided student loan program has been rendered hollow and absurd by the current credit crunch and the collapse of securitization. Banks have been pulling out of the program by the dozens. On top of the normal 95% guarantee, the federal government has made available TALF funding to buy up student loans to the tune of up to $200 billion. If Obama's proposal succeeds, this bailout money can be used for its other purposes--credit cards and auto loans, for example.

via TitaniumDreads, via Future Majority;

Boomerang Kids Story in Phila. Inquirer

Tuesday, March 10, 2009

Obama Gets Tough On Education; What About Higher Ed?

It’s interesting that Obama, a part-time university professor, takes on teachers’ unions, but ignores rampant inflation in university tuition.

Why does Obama demand accountability of grade-school teachers, but not of universities? Tuitions have gone up 400% in about the last decade. There is absolutely no justification for such egregious increases.

Obama’s plans to offer even bigger tuition subsidies, without requiring reform of university finances, will simply feed more inflation that undoes the benefits of scholarships and loans.

Universities are run with the same condescension and air of entitlement that plagues Wall St., and taxpayers are footing the bill in both cases.

Sunday, March 08, 2009

Define "Generation"

"loss of confidence on the part of both parent and children that life in the next generation will inevitably be better.”

"Today, the most immediately affected may be the oldest members of Generation Recession — those in high school and college. Research shows that the wages of those graduating into the recession of the 1980s were held back for more than a decade. And weak stock markets tend to make the young more risk averse about investing into the next decade."

(Risk averse is not necessarily such a bad thing, is it? I mean, isn't the popular approach to investing overdue for a correction?)

More civic-minded, more creative, closer to their families...it's not all bad.

Thursday, March 05, 2009

Student Newspaper story on UT-Knoxville speech

"A sustainable economy is one that does not rely on borrowing from the future to support the present, she said. She added, The Great War of this generation may be climate change."

Wednesday, March 04, 2009

Sayonara, FFELP!

Obviously, I have been calling for this for years. I'm sorry it took a global economic crisis and credit crunch to get us here, but publicly supported student lending is definitely the better way to go.

However, these days I'm more concerned about the multiple underlying factors that keep driving the cost of college upward, and increasing federal aid is actually not helping in the long run. For example, last night I visited the University of Tennessee at Knoxville (Go Vols!)

According to what the very intelligent and engaged members of the student Issues Committee told me, The school is going through simultaneous budget cuts and a 9% tuition increase. The budget cuts are so severe that 5 to 7 percent of students won't be able to get into the classes they need to graduate , which may force them to add another semester or even another year, which raises their burden even more! Simultaneously, a giant stadium renovation is going on, to the tune of $200 million. The students are steamed! But apparently the concerns of families and students are not being consulted here.

Monday, March 02, 2009

State Loan Forgiveness Program is Out of Cash

Students Are Flocking to Public Colleges

"Over the last decade, enrollment in the SUNY system has grown by 20 percent. But officials at New Paltz do not want to grow, and instead see the swelling applicant pool as a way to further refine its status and student body. In the last five years, the college has winnowed the student-to-faculty ratio to 14 to 1, from 17 to 1; more than two-thirds of courses are taught by full-time faculty members today, compared with 50 percent a decade ago."